In 2023, around 2.33 billion people globally faced moderate or severe food insecurity. That alarming number continues to increase due to climate change, diseases, and a growing population. So, what can the food manufacturing sector do to help?

Novel proteins could be one potential solution to this pressing global problem. Novel proteins not only have a positive impact on our planet but also on the agricultural and food sector. In fact, since 2019, the market for meat substitutes in Europe has doubled in value. The growing market and increased investments will only continue in the next few years, creating a great opportunity for the agricultural and food sector.

What are Novel Proteins?

The University of Nottingham defines alternative proteins as:

“Alternative protein, such as plant-based meat substitute, or edible insects, provides a substantial amount of protein, but requires less natural inputs (e.g. water) to produce, compared to the most common and conventional protein sources (i.e. meat and fish). They are also called ‘novel food proteins’ and are composed of different sequences of amino acids, which are responsible for building lean body tissues and human health.“

There are different groups of alternative proteins available:

Plant-based

This group contains proteins derived from vegetables, herbs, and other plants. There are three distinctions to consider:

- Unprocessed and minimally processed: Plant-based proteins that are unprocessed or minimally processed, such as lentils or chickpeas.

- Processed: These products are more processed, like soya-based tofu or oat milk.

- Ultra-processed: Products made with biotechnology.

Plant-based proteins are an easy and popular way to replace meat products. Think about products like tofu or dairy-free milk, which can be easily bought in every supermarket. However, unprocessed plant proteins are lower in protein than animal proteins, which can be partially addressed by processing the proteins more.

The biggest challenge of plant-based protein is the lower protein content compared to other sources like animal-based protein and the rising concern around its environmental impact, even though it is smaller than traditional protein sources. For example, soy production takes up...

Cell-based

Cell-based proteins are derived from animal cells and produce cultivated meat, including seafood and organ meat. Cultivated meat is composed of the same cell types as conventional meat, arranged in similar structures to replicate the sensory and nutritional characteristics of traditional animal tissues.

The greatest advantage of this novel protein is that there is no need for animal farms, which improves animal welfare and reduces the impact on the environment. Nevertheless, the biggest challenges for this novel protein are texture, taste, initial costs, and scaling up production.

How is cultivated meat made?

- Cell Extraction: A small sample of animal cells (usually muscle or stem cells) is taken from tissue.

- Cell Cultivation: Cells are placed in a nutrient-rich medium and grown in bioreactors, where they multiply and develop.

- Differentiation: Cells are induced to become muscle and fat cells, mimicking natural meat tissues.

- Scaffolding: Cells are grown on scaffolds to form a 3D structure that replicates meat’s texture.

- Maturation: Cells continue to grow and mature into tissue that resembles conventional meat.

- Harvesting & Processing: The final product is harvested, processed into desired forms (e.g., steaks, ground meat), and tested for quality and safety.

Microbial-based

Also, dried cells of microorganisms like fungi, algae, mycelia, and other types of microorganisms can be used as a novel protein when grown in a large-scale culture system. An example of microbial proteins or single-cell proteins (SCP) is is Quorn mycoprotein, which is made from the fungus Fusarium venenatum.

There are three overlapping fermentation processes:

- Traditional fermentation: This process applies to many other products like beer or cheese. The main goal is to improve flavour or functionality.

- Biomass fermentation: High-protein content and rapid growth of microorganisms are used to make large amounts of protein-rich food.

- Precision fermentation: This process enables scientists to extract different specific products from a microbe, like fats, proteins, or vitamins. These proteins can be combined with other organic molecules to form a product that looks and tastes like an animal product.

This type of novel protein shows a lot of potential, requiring less land and being a good fishmeal replacement. However, EU regulation can be quite complicated according to a study of the European parliament:

“Precision-fermented products are generally considered to be novel foods under Regulation (EU) 2015/2283. If the product is obtained through the use of genetically modified organisms (GMOs), it must be authorised under Regulation (EC) No 1829/2003 on genetically modified food and feed if rDNA from the GMO is still present in the fermentation product.”

Insect-based

Lastly, insects have been used in food for hundreds of years around the world, being a great source of protein. A study by the European Parliament shares that four insect species are being used in the EU: “house cricket (Acheta domesticus); lesser mealworm (Alphitobius diaperinus); migratory locust (Locusta migratoria); and yellow mealworm (Tenebrio molitor)”. The same study showed that in 2019, the EU produced 500 tonnes of insects for food and 5,000 tonnes for feed.

The benefit of insect-based protein is that it’s nutritious, with a protein content of up to 60-77% (dry matter). Unfortunately, due to restricted availability, the price can be high.

Global Situation and Needs

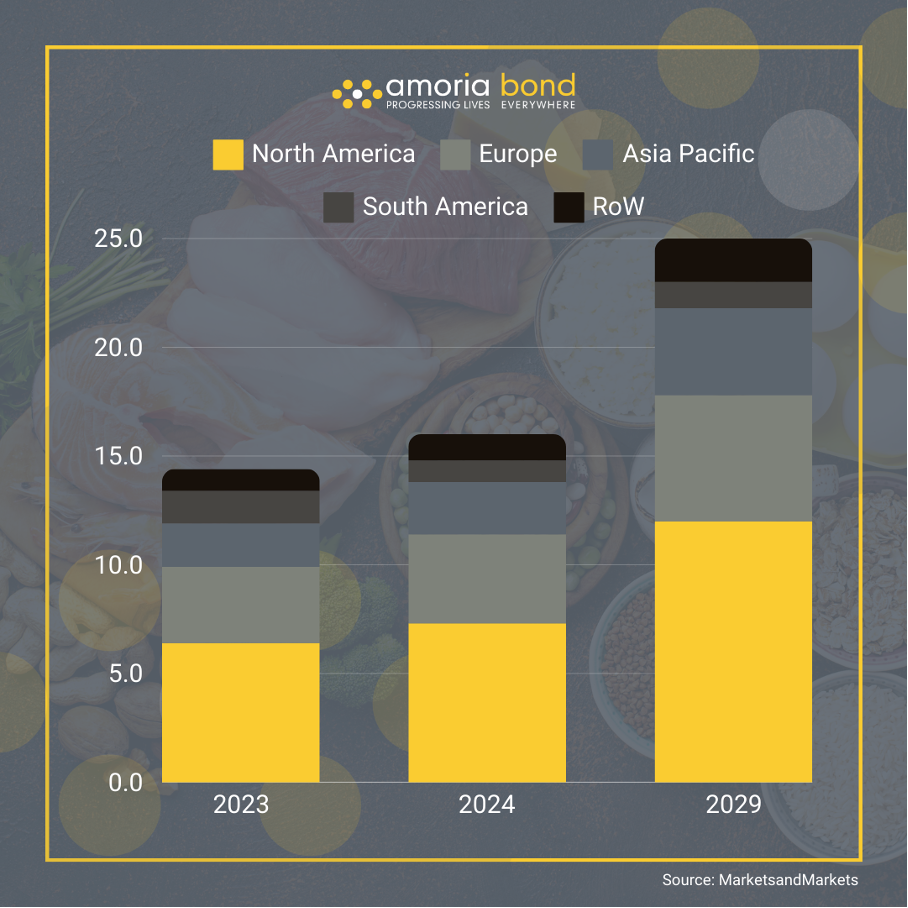

MarketandMarkets made a global forecast of the worth of the global proteins market:

Especially, the meat substitutes market in the European Union is showing growth and increased interest from consumers, with 133,000 metric tons of meat substitutes consumed every year.

According to Statista, Germany is the largest producer of plant-based meat, with sales of over 640 million euros, followed by the United Kingdom. Although Germany is the largest producer, Dutch residents spend the most on meat substitutes, a third more to be exact. The only market that is less favourable towards meat substitutes is the French market, where only a tenth of consumers in France plan to eat more substitutes in the future.

Statista provided an overview of the revenue of the meat substitutes in the European Union (EU-27) from 2018 to 2029 in U.S. dollars.

The graphic above shows a steady growth between 2018-2029. In those years, Statista even forecasts that the revenue will be more than 3 billion dollars in 2029.

Global Situation

With environmental challenges in consideration, current food production will have to double by 2050 to meet the global increasing food demand.

The traditional protein source being animal proteins isn’t sustainable for various reasons like animal welfare, environmental impact, diseases and health impact on humans. Therefore, the food industry must adapt to stay competitive, innovative and keep up with global needs.

That’s where novel proteins play a pivotal role. Novel proteins offer a range of significant advantages, particularly in terms of sustainability and environmental impact. One of the most notable benefits is their potential to reduce the ecological footprint of food production. Traditional animal agriculture is a major contributor to greenhouse gas emissions, deforestation, water use, and land degradation. Novel proteins, by contrast, require far fewer natural resources—many plant-based and fermentation-derived proteins, for example, use less water and land compared to livestock farming. Cultivated meat can also reduce the need for large-scale animal farming, which would significantly lower emissions and other environmental impacts. As these alternative proteins scale up, they offer the opportunity to build a more sustainable food system with fewer negative consequences for the planet.

In addition to environmental benefits, novel proteins can contribute to improved food security and address global challenges such as the growing demand for protein, rising food prices, and the inefficiency of traditional animal farming. These alternative proteins can be produced more efficiently, often using less land, water, and feed than conventional livestock. Moreover, they offer the possibility to create more nutritionally tailored products that can meet specific dietary needs or preferences. For example, novel proteins can be designed to have higher levels of essential nutrients or be fortified with vitamins and minerals that are lacking in some diets. These proteins also hold the potential to improve animal welfare, as they can be produced without the need for raising and slaughtering animals, appealing to ethical consumers and those concerned with animal rights. As such, novel proteins offer a promising path toward a more sustainable, ethical, and resilient global food system.

Acknowledging the importance and potential, institutions and organisations like the EU have been supporting several projects to advance novel protein technologies, such as the NextGenProteins project. The project aims to optimise the production and assess the effectiveness of three alternative proteins, ensuring they meet customer needs and gain consumer acceptance. The project also supports smaller businesses that want to develop novel proteins to scale up.

Challenges

Novel proteins come with as many challenges as advantages and opportunities. Here are a few of the most important challenges to consider:

- Production costs: Some processes, like fermentation and insect farming, require specific equipment and a lot of energy to produce the novel protein, which can come with high investment costs.

- Regulatory support: Although regulations are being put in place by the EU and other institutions and countries, there is still progress needed in this area. Some laws can be complex, which can be a hurdle for some food companies.

- Consumer acceptance: This challenge is the most important one since the goal of novel protein is to imitate animal-based meat. Because novel proteins aren’t a common product nor is there common knowledge of how they’re made, some consumers can be hesitant to try and eventually buy them.

- Scaling-up production: Transitioning from small-scale, lab-based production to large-scale commercial operations remains difficult. This includes developing efficient systems for large-volume production, minimising waste, and optimising resources to lower costs.

Future of Novel Proteins Sector

In 2024, the global proteins market is expected to be worth 15.7 billion dollars and will grow at a CAGR of 9.9% between 2024 and 2029. This growth reflects a broader shift towards sustainable and ethical food choices, driven by consumer demand and environmental concerns. The sector is growing, which is also visible in the growth of investments. Over the past five years, 4 billion dollars have been invested to develop novel proteins.

McKinsey conducted a survey of more than 1,500 US consumers to explore their opinions about 12 novel protein ingredients and what companies should focus on in their future development of novel protein products. The results were very positive, with the majority of consumers reporting that they were willing to try food and beverages that contained novel products. The most popular options were plant-based novel proteins like almond (82%) or soy (75%) protein, whereas mycoprotein (49%) and other fungi proteins scored the lowest.

The report also highlighted that the education and marketing of such products are important for their success, including wording and target group. Phrases like ‘Good or complete source of protein’ and ‘Antibiotic- and hormone-free’ scored very high, while other terms like ‘Next-gen’, ‘Made with biotechnology’, or ‘Bioengineered’ weren’t very appealing to the testers. This means that the future of novel proteins isn’t only about the technology itself but also about marketing the product and explaining it to its audience. Forty-four percent were even uninterested in trying any novel product, correlated to a lack of awareness and understanding of its production.

Lastly, McKinsey found that consumers were more interested in trying out novel protein products in the form of a snack, breakfast, or lunch rather than dinner. For these products, almost half of consumers were willing to pay more.

The team of the NextGenProteins Project also found that the biggest challenge wasn’t environmental sustainability but that companies should focus on price competitiveness, promoting the sustainability credentials, good product development and marketing.

In conclusion, the future of the novel protein sector is bright with a few hurdles to overcome, such as consumer acceptance and scaling up production. Nevertheless, with increasing investments and the potential of certain technologies, especially fermentation, the novel protein sector will boom in the next few years, developing itself as a worthy competitor to traditional meat.

The War for Talent in the Food Sector?

As multiple companies are trying to scale up their novel protein production and enhance processes, it’s difficult to find life science specialists with the right skills. Almost half of European businesses are struggling to find the right STEM specialists for job openings, resulting in delays and loss of revenue. So, what can food companies do?

Recruitment companies like Amoria Bond can help find niche skilled engineers, scientists, and specialists for specific roles. These organisations give employers access to a global talent pool of qualified candidates suited to critical C, D, and E level management positions and mid to senior-level roles. This allows companies to find the perfect fit in less time.

Recruitment organisations also look beyond just skills; experienced recruiters only recruit people who are a fit for the company beyond a specific project. Above that, recruitment processes are more likely to be transparent and quicker than internal hiring processes, which can result in the loss of potential candidates.

Why Work with Amoria Bond?

Amoria Bond has more than 15 years of experience in various STEM sectors, delivering the best service possible. For permanent and executive search, our recruiters need just 2-4 weeks, reducing your costs and time. For niche roles, like those in the novel proteins sector, we have an extensive global candidate network with a 90% fill rate.

Because of our global offices, we can ensure our clients receive assistance 24/7 for any international job role. Additionally, we offer clients tailored services and full support throughout the entire hiring process.

Are you interested in our services, or do you need to fill a niche life sciences role? Don’t hesitate to contact us for more information about how we can help your company progress!